According to the fifth annual Global Crypto Adoption Index from Chainalysis, global cryptocurrency adoption is increasing, particularly in Central and Southern Asia.

The report highlights that global cryptocurrency engagement is on the rise, driven by factors such as technological advancements and shifting perceptions of digital assets.

To determine the leading countries in crypto adoption, Chainalysis ranks nations based on the total cryptocurrency value received by centralized services, adjusted by GDP per capita on a purchasing power parity (PPP) basis. This ranking estimates the on-chain value received in each country and adjusts it for GDP per capita, weighted by PPP. Countries where the cryptocurrency value received constitutes a larger portion of the average person's income rank higher. If two countries receive the same amount of cryptocurrency, the one with the lower GDP per capita (adjusted for PPP) is ranked higher.

According to the GCA Index, India leads the world in crypto adoption, followed by Nigeria, Indonesia, the United States, and Vietnam. The U.S. is the only Western country in the top 10. Russia and Ukraine are closely following the top five.

Global crypto activity

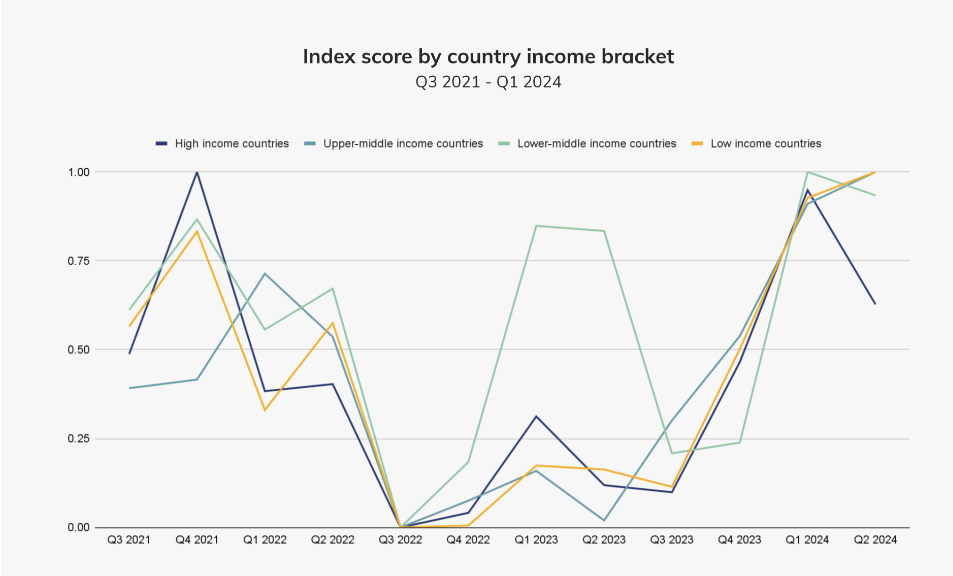

Globally, the total value of cryptocurrency activity has risen significantly, surpassing levels seen during the 2021 crypto bull market. This trend is evident in the chart below, where Chainalysis applies the Adoption Index methodology across all 151 countries for each quarter from Q3 2021 to Q2 2024, re-indexing to show global adoption growth over time.

The report highlights that global cryptocurrency engagement is on the rise, driven by factors such as technological advancements and shifting perceptions of digital assets.

To determine the leading countries in crypto adoption, Chainalysis ranks nations based on the total cryptocurrency value received by centralized services, adjusted by GDP per capita on a purchasing power parity (PPP) basis. This ranking estimates the on-chain value received in each country and adjusts it for GDP per capita, weighted by PPP. Countries where the cryptocurrency value received constitutes a larger portion of the average person's income rank higher. If two countries receive the same amount of cryptocurrency, the one with the lower GDP per capita (adjusted for PPP) is ranked higher.

According to the GCA Index, India leads the world in crypto adoption, followed by Nigeria, Indonesia, the United States, and Vietnam. The U.S. is the only Western country in the top 10. Russia and Ukraine are closely following the top five.

Global crypto activity

Globally, the total value of cryptocurrency activity has risen significantly, surpassing levels seen during the 2021 crypto bull market. This trend is evident in the chart below, where Chainalysis applies the Adoption Index methodology across all 151 countries for each quarter from Q3 2021 to Q2 2024, re-indexing to show global adoption growth over time.

A surge in crypto activity in across countries of all income levels

Last year's growth was primarily driven by the middle class. However, this year, crypto activity has expanded across countries of all income levels, though there has been a decline in high-income countries since the beginning of 2024.

Last year's growth was primarily driven by the middle class. However, this year, crypto activity has expanded across countries of all income levels, though there has been a decline in high-income countries since the beginning of 2024.

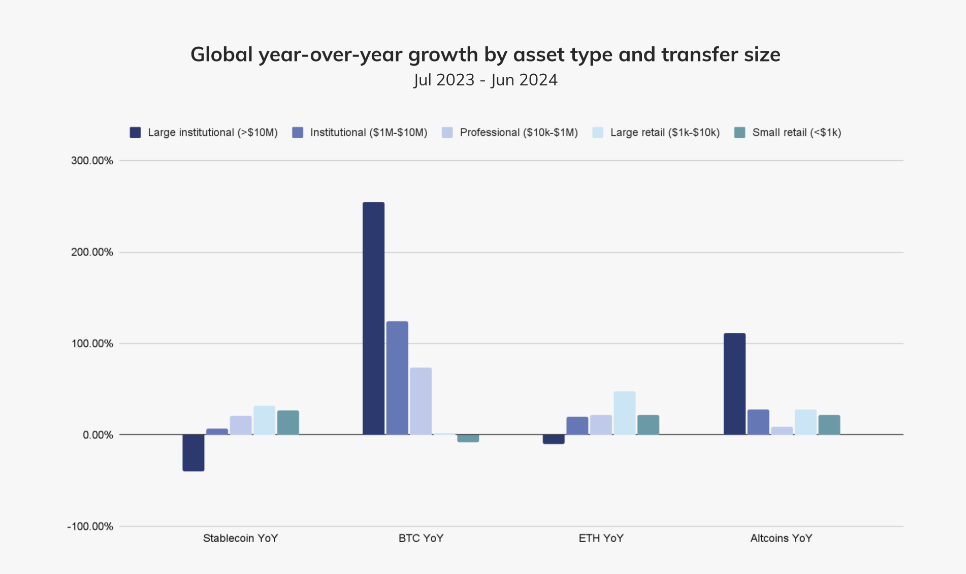

A surge in institutionally-backed transactions

The launch of the Bitcoin ETF in the United States triggered a surge in the total value of Bitcoin transactions worldwide, especially in institutional-sized transfers and higher-income regions like North America and Western Europe. In contrast, stablecoins saw higher year-over-year growth in retail and professional-sized transfers, supporting real-world use cases in low and lower-middle income countries, particularly in regions such as Sub-Saharan Africa and Latin America.

The launch of the Bitcoin ETF in the United States triggered a surge in the total value of Bitcoin transactions worldwide, especially in institutional-sized transfers and higher-income regions like North America and Western Europe. In contrast, stablecoins saw higher year-over-year growth in retail and professional-sized transfers, supporting real-world use cases in low and lower-middle income countries, particularly in regions such as Sub-Saharan Africa and Latin America.